So Roger Milliken beat the tax man…, something his grandfather was unable to do. Mr. Millikin died just ahead of the reinstatement of estate taxes… Following is an excerpt from an article with an interesting history of estate taxes by Ryan J. Donmoyer in the the January 5, 2011 edition of Bloombergweek. I find tax records to be of great help to genealogists, so the article immediately caught my eye.

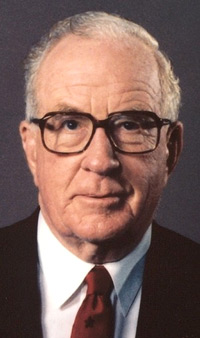

Jan. 5 (Bloomberg) — Textile tycoon Roger Milliken ducked the taxman upon his death almost a century after his grandfather lost a landmark legal fight with the U.S. government over sheltering a fortune from the estate tax.

The 95-year-old Milliken, chairman of Milliken & Co., one of the world’s largest closely held textile, chemical, and floor-covering manufacturers, died in a Spartanburg, South Carolina, hospice on Dec. 30, less than 48 hours before a temporarily lapsed federal tax on multimillion-dollar estates was to be reinstated.

…

The federal estate tax was reinstated this year. Had Roger Milliken died Jan. 1, he would have faced a top rate of 35 percent after a $5 million tax-free allowance. His fortune peaked at $1 billion in 2003, according to Forbes magazine. It has declined since, along with the U.S. textile industry.